What is The Veblen Effect?

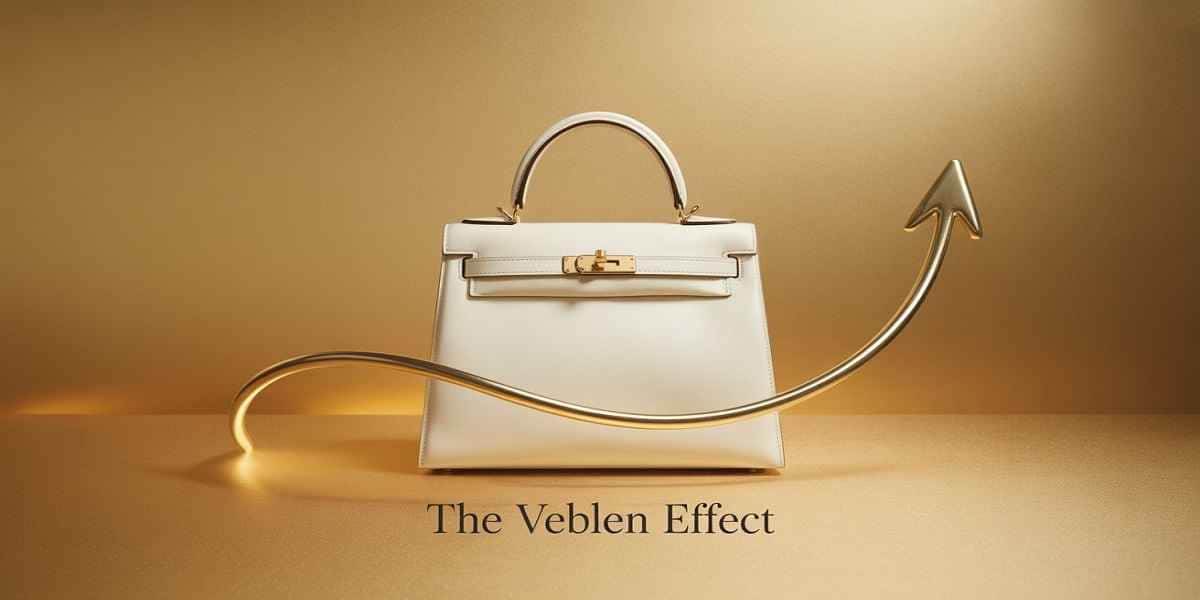

Why do people spend thousands on a designer handbag when a more affordable option exists? The answer lies in the Veblen Effect. This economic phenomenon flips traditional supply-demand logic on its head. Normally, higher prices reduce demand. Yet, for certain luxury goods, the opposite happens.

A steep price tag becomes a magnet, not a deterrent. Status-driven spending fuels this paradox. It transforms products into trophies. Think Rolex watches, Lamborghini cars or limited-edition streetwear. These items are not just purchased for utility. They are worn, displayed and flaunted to signal wealth and social standing.

Are you part of this market? Do you know someone who is? The Veblen Effect thrives in a world obsessed with visibility. Instagram posts, red-carpet events and viral unboxing videos amplify the allure of exclusive brands.

But how did this trend begin? What psychological triggers drive consumers to prioritize prestige over practicality? And why do luxury brands rely on this effect to shape their strategies? Let’s unpack the mechanics of status-driven spending and its ripple impact across global markets.

Origins of the Veblen Effect

Thorstein Veblen coined the term in his 1899 book The Theory of the Leisure Class. He observed that the wealthy engaged in “Conspicuous Consumption” buying goods not for their function but to display financial power. Veblen’s critique targeted the emerging upper class of his era, who flaunted opulent lifestyles to differentiate themselves from the working class. His words still resonate today: “The greater the cost, the greater the honor.”

Consider the diamond industry. A century ago, diamonds were rare but not wildly expensive. De Beers’ 20th-century marketing campaigns linked diamonds to eternal love, creating artificial scarcity and sky-high prices. The result? A product once reserved for royalty became a status symbol for the masses, albeit one that requires draining savings to purchase.

The Veblen Effect isn’t confined to history. It evolves with culture. Today, luxury streetwear brands like Supreme or Fear of God charge premium prices for hoodies and t-shirts. The fabric costs remain modest. The markup stems from brand equity. Owning these items grants entry to an elite tribe.

How Status-Driven Spending Defies Economic Logic

Typical demand curves slope downward: as price increases, demand decreases. The Veblen Effect creates an upward-sloping curve. A higher price elevates perceived value. This anomaly thrives in markets where exclusivity matters more than utility.

Take Hermès Birkin bags. Starting at $10,000, they’re handcrafted with meticulous detail. Yet, the waitlist stretches years. Why? Ownership becomes a badge of access. Celebrities and billionaires hoard them not because they need storage but because they crave the social capital these bags represent.

Luxury brands exploit this psychology deliberately. Limited releases, numbered editions and VIP-only collections engineer scarcity. The message is clear: This item is not for everyone. When Balenciaga released a $1,400 plain black tote, critics scoffed. But the absurdity itself became the point. Only those “In the Know” could appreciate its ironic exclusivity.

The Psychology Behind the Purchase

Why do humans equate spending with status? Evolutionary biology offers clues. In ancestral tribes, displaying resources, like owning rare materials or hosting lavish feasts, signaled strength and reliability. Modern luxury consumption mirrors this primal urge.

Social comparison theory adds another layer. Psychologist Leon Festinger argued that people determine their self-worth by comparing themselves to others. A Tesla Model S or a Cartier watch becomes a nonverbal declaration: I’ve made it. This mindset fuels a cycle of competitive spending.

Consider the rise of “Quiet Luxury.” Unlike flashy logos, this trend prioritizes understated elegance, a cashmere sweater with a tiny embroidered emblem. The subtlety signals sophistication to those who recognize the brand’s heritage. It’s exclusionary by design.

Case Studies: Brands Mastering the Veblen Playbook

- Rolex: The Swiss watchmaker hasn’t changed its core designs in decades. Yet, waitlists grow yearly. Steel Daytona models retail for $15,000 but resell for triple that. Rolex manipulates supply ruthlessly, ensuring perpetual undersupply. The message? Ownership is a privilege, not a transaction.

- Supreme: Once a niche skate brand, Supreme became a global phenomenon by selling $500 box logos. Collaborations with Louis Vuitton and Nike blurred streetwear and high fashion. Its strategy? Drop small quantities weekly, fuel hype through celebrity endorsements and let resale markets inflate prices.

- Maybach: Mercedes revived this ultra-luxury car line to cater to buyers needing more than a regular S-Class. At $200,000+, the Maybach’s stretched wheelbase serves no functional purpose. It exists solely to announce wealth.

These examples highlight a shared blueprint: inflate prices, limit availability and weaponize cultural relevance.

The Role of Storytelling in Luxury Marketing

A product’s narrative often outweighs its physical attributes. Luxury brands invest millions crafting myths around craftsmanship, heritage and celebrity associations.

Take Louis Vuitton’s bag-making legacy. Founded in 1854, the brand leverages its history as a supplier to European aristocracy. Ads feature A-listers like Emma Stone, evoking timeless elegance. The average buyer isn’t purchasing luggage; they’re buying a fragment of that legacy.

Similarly, Patek Philippe’s slogan“You never actually own a Patek Philippe. You merely look after it for the next generation” transforms watches into heirlooms. The emotional weight justifies six-figure price tags.

Digital storytelling amplifies reach. Instagram influencers unbox $3,000 handbags while YouTube reviewers dissect sneaker collaborations. These platforms democratize aspiration, making luxury feel accessible, even as prices remain prohibitive.

Impact Across Industries

The Veblen Effect isn’t limited to fashion or watches. It permeates sectors where perception trumps practicality:

- Real Estate: Manhattan penthouses and Beverly Hills estates sell for tens of millions, partly due to location but largely because of bragging rights. A home becomes a trophy asset.

- Automotive: Electric cars like Lucid Air or Porsche Taycan Turbo S command premiums despite rivals offering similar specs at lower prices. The brand aura justifies the cost.

- Technology: Apple’s M1 Max MacBook Pro retails at $4,000, a price justified less by specs than by the Apple ecosystem’s cult-like loyalty.

- Art: Banksy prints sell for millions posthumously, not because his work improves but because scarcity and fame inflate demand.

In each case, the product’s symbolic value eclipses its functional worth.

Ethical Criticisms and Backlash

Critics argue the Veblen Effect perpetuates materialism and inequality. When brands prioritize profit over ethics, sweatshop labor, environmental harm and exploitative marketing often follow.

The 2017 “Dumb Starbucks” saga highlighted this tension. A Los Angeles man sold $4 lattes labeled “Kaws” for $40, mocking how consumers pay premiums for logos. The stunt went viral, exposing the absurdity of status-driven pricing.

Sustainability advocates also challenge the model. Fast fashion brands like Shein churn out trendy clothes at low costs, encouraging disposable consumption. Conversely, luxury brands destroy unsold inventory to maintain exclusivity, a practice criticized as wasteful.

Yet, some companies adapt. Stella McCartney uses eco-friendly materials without sacrificing prestige. Patagonia’s “Don’t Buy This Jacket” campaign urged conscious consumption, paradoxically boosting brand loyalty. The future may see Veblen strategies merging with ethical imperatives.

The Veblen Effect in the Digital Age

Social media has turbocharged status-driven spending. Platforms like Instagram and WeChat turn purchases into public performances. A Gucci belt or Audemars Piguet watch gains value through likes and shares.

NFTs and digital fashion exemplify this shift. Why wear a Balenciaga shirt in person when you can flaunt a virtual one in Fortnite? Gucci’s $4 virtual sneakers and Burberry’s NFT aquariums cater to a generation where online identities rival physical ones.

Cryptocurrency also intersects with the Veblen Effect. Bitcoin millionaires flaunt hardware wallets like Ledger as symbols of tech-savvy wealth. Tesla’s Dogecoin acceptance in 2021 wasn’t about utility, it was a flex.

Counter-Movements: Minimalism and Anti-Luxury

Not everyone buys into the hype. The minimalist movement, popularized by authors like Joshua Fields Millburn, champions decluttering and rejecting materialism. Brands like MUJI and Everlane thrive by emphasizing simplicity over logos.

Secondhand markets also challenge the Veblen paradigm. Depop and Vestiaire Collective let users resell luxury goods, undermining brand control over pricing. Yet, even this trend has a twist: vintage Hermès or limited-edition Jordans often resell for more than retail, feeding the status economy anew.

The Future of Status-Driven Markets

Three trends will shape the Veblen Effect’s evolution.

- Hyper-Personalization: Brands like Bentley and Rolls-Royce let buyers customize cars with bespoke paint and interiors. The rarer the specification, the higher the prestige.

- Experiential Luxury: Five-star hotels and private travel increasingly compete with physical goods. A $10,000 safari in Botswana holds more social currency than a Rolex.

- Decentralized Status Symbols: Web3 communities reward NFT ownership or crypto holdings. Digital badges in metaverse platforms like Decentraland may replace traditional luxury.

Will these shifts dilute the Veblen Effect or amplify it? Only time will tell.

Conclusion: The Enduring Power of Perception

The Veblen Effect persists because humans are wired to seek recognition. Luxury brands exploit this truth with precision, turning products into paragons of prestige. As long as societies equate wealth with worth, status-driven spending will thrive.

But awareness empowers choice. Next time you covet a luxury item, ask: Am I buying this for its utility or its symbolism? The line between necessity and aspiration grows blurrier by the day.

FAQs

Q1: What is the Veblen Effect?

A1: The Veblen Effect describes a phenomenon where demand for certain goods increases as their prices rise, driven by their perceived status or exclusivity. These items become symbols of wealth, making higher costs a selling point rather than a barrier.

Q2: How does the Veblen Effect differ from typical supply-demand dynamics?

A2: Normally, demand decreases as prices rise. The Veblen Effect defies this by creating an upward-sloping demand curve, higher prices elevate perceived value, attracting buyers seeking prestige.

Q3: Can you provide real-world examples of the Veblen Effect?

A3: Examples include Hermès Birkin bags (Priced at $10,000+ with years-long waitlists), Supreme streetwear (Limited drops reselling for triple retail) and Rolex watches (Artificial scarcity maintaining their luxury allure).

Q4: What psychological factors drive the Veblen Effect?

A4: Evolutionary instincts (Signaling strength through resource display), social comparison theory (Measuring self-worth against others) and cultural narratives linking luxury to success all play roles.

Q5: Which industries are most influenced by the Veblen Effect?

A5: Luxury fashion, watches, automotive (Example, Maybach), real estate (Manhattan penthouses), art (Banksy prints) and even tech (Apple’s premium pricing) leverage status-driven spending.

Q6: Are there ethical concerns tied to the Veblen Effect?

A6: Critics argue it perpetuates materialism, inequality and environmental harm. Luxury brands often destroy unsold inventory to maintain exclusivity, while fast fashion exploits labor to mimic high-end trends.

Q7: How has social media amplified the Veblen Effect?

A7: Platforms like Instagram and Instagram turn luxury purchases into public performances. Digital status symbols (Example, NFTs, Virtual Fashion) and influencer culture now extend the effect into online spaces.

Q8: What counter-movements challenge the Veblen Effect?

A8: Minimalism, secondhand markets (Example, Depop) and sustainable brands like Patagonia or Stella McCartney promote conscious consumption, rejecting overt status signaling.

Q9: How might the Veblen Effect evolve in the future?

A9: Trends include hyper-personalization (Bespoke Luxury), experiential spending (Private Travel) and decentralized status symbols (NFTs in metaverse platforms).

Q10: How can consumers identify Veblen goods?

A10: Look for products where price hikes correlate with increased demand despite minimal functional upgrades. Limited editions, brand heritage and cultural hype are common indicators.

Tags: Veblen Effect Status-Driven Spending Luxury Market Trends Consumer Behavior Economic Theory Brand Psychology Status Symbols Social Media Influence Conspicuous Consumption